My Role

Principal Designer, Presenter, Information Architect, Prototyper, Product Manager

The Team

Stephen Perkins, Oliver Jones

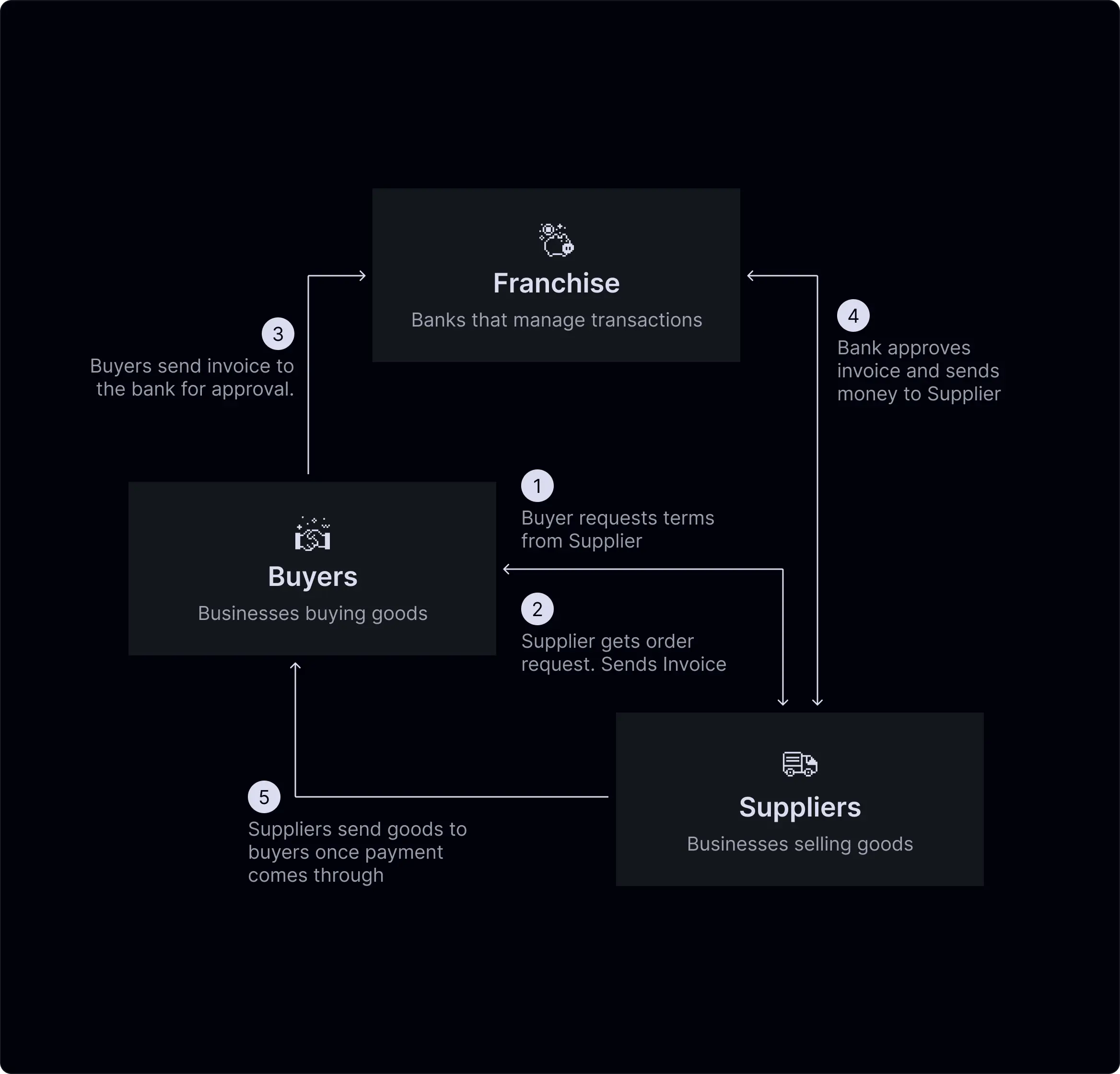

Diners Club International, part of Discover, kicked off an exciting project with our team to redefine the management of financial transactions and partnerships across Europe. The goal was to automate and refine the manual process of researching and approving new business partnerships, making it more efficient and less time-intensive. This required overcoming the complexities of constructing a marketplace for three distinct parties, managing cross-currency transactions, and complying with varied regulatory standards across nations.

We pinpointed several opportunities that promised to benefit our clients and their customers significantly:

The simplification of financial exchanges among banks, businesses, and card issuers could catalyze an increase in transaction volume, boosting revenue from fees and solidifying Discover's foothold in the European financial market.

Buyers gain a tool that can streamline the procurement process, enabling them to focus more on their core business activities by reducing the time and complexity involved in managing transactions.

Enhanced tools for Franchises to manage relationships with buyers and suppliers, potentially increasing their revenue through a more vibrant economic ecosystem.

"The process of vetting partners is overwhelming. The paperwork is never-ending, draining our resources and focus."

— Adriano, Franchise Manager

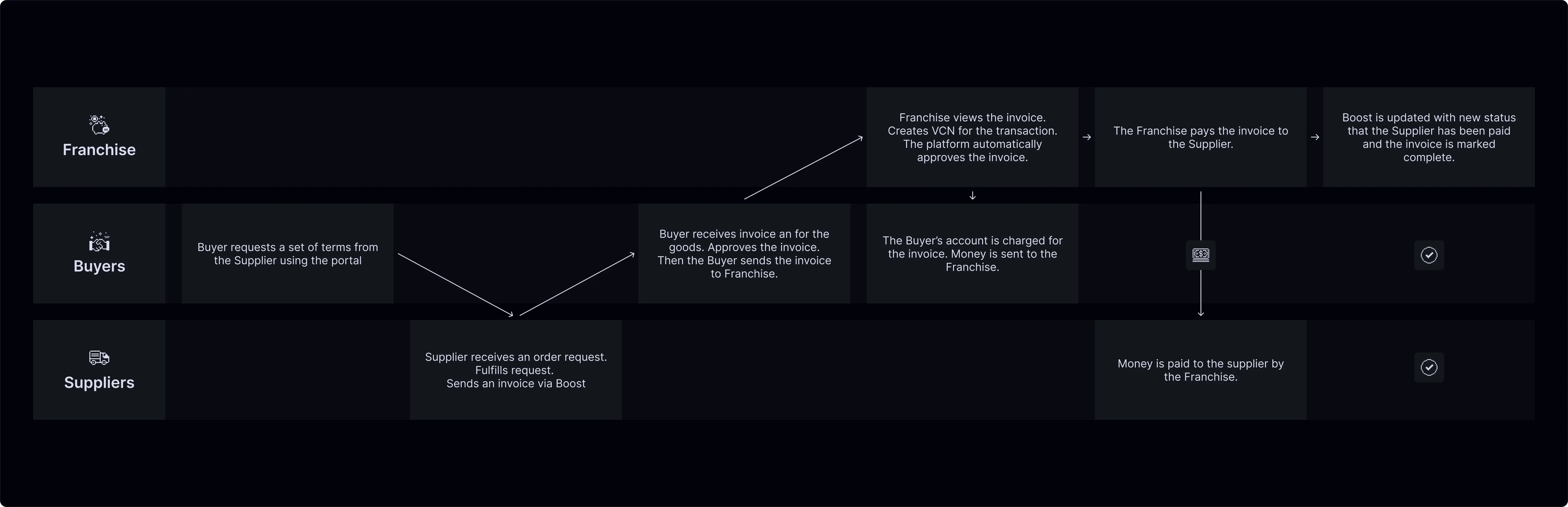

The challenge was to streamline a complex platform that served a three-sided market, while managing the complexities of international finance regulations and multi-currency transactions. Our goal was to focus closely on the specific needs of each user group, transforming a convoluted, multi-step process into clear, user-focused steps. This approach aimed to not only enhance the user experience but also ensure compliance and efficient handling of diverse financial transactions.

From the outset, our biggest challenge would be to serve a diverse set of users—franchises, buyers, suppliers, and DCI admins—each with distinct needs and workflows.

Franchises: (i.e. Banks) issue procurement cards, manage payments, conduct due diligence on suppliers, and facilitate economic relationships.

Buyers: Businesses that manage and request connections with suppliers, request invoices, and submit payments.

Suppliers: Businesses that sell goods, create invoices, request connections to buyers, and receive payments. Suppliers have the least functionality on the platform.

DCI Admins: Oversee platform access, monitor activity, and address issues.

From the start, we knew that this platform was going to be big—and there would be a lot of data to show. To help keep everything straight, we charted intersections between user types and their feature usage, ensuring clarity in the platform's extensive data presentation.

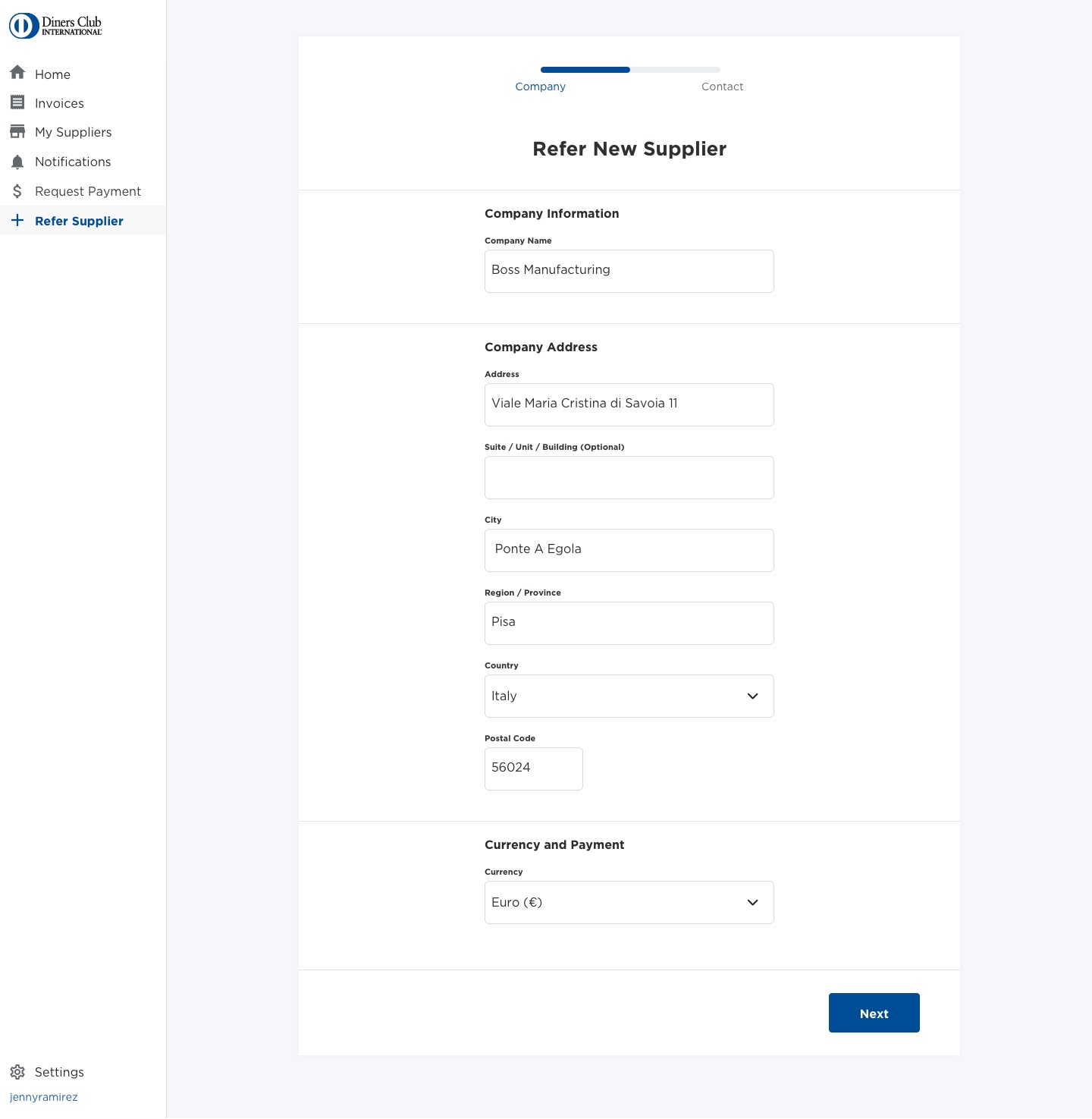

A crucial step that precedes invoicing and payment activities is the approval process for suppliers within the network. Recognizing this, we developed an application and referral system. This allowed buyers to fast-track the introduction of new suppliers into the system, simultaneously offering suppliers an avenue to expand their business by joining the approved network for potential buyers.

Through this application, Diners Club gains insight into select financial statements and business histories of suppliers, dramatically reducing the approval timeframe from weeks to mere hours.

The launch in Diners Club Italy garnered overwhelmingly positive feedback, particularly from franchises praising the platform's simplification of relationship management. Motivated by this success, plans are in place to enhance features, explore new markets, and introduce cross-currency functionalities.

Increase in transaction volume.

Rise in cross-border partnerships in the first year.

Faster processing of partnership requests.

Growth in the network of approved suppliers.